A few weeks ago, I had a discussion with a reporter who wanted to know why nobody seemed to care about governmental corruption. He had spent God knows how many hours on a story about a local official’s slush fund, and he expected the article to hit like a neutron bomb … only to be met with widespread ennui from everybody in the district once the “news” finally dropped.

Well, I didn’t have the heart to tell him at the time, but there’s a very specific reason why John and Joan Q. Public just don’t give a damn when their tax dollars wind up being misappropriated. Basically, it’s for the same reason mugging victims don’t give a hoot what the mugger uses their stolen credit card for … if you have to give up your moolah at gunpoint, why should you care how other people spend the money they FORCIBLY took from you?

Simply put, it doesn’t matter what a corrupt politician spends his or her usurped funds on. That’s because the American taxpayer had to fork over a good 30 to 40 percent of their annual income and they know they ain’t ever going to get it back. What the money is used for doesn’t mean a damn thing – it’s the fact that you HAVE to give the government anywhere from a third to two-thirds of your yearly earnings that really infuriates the masses.

Despite taxation being the number one source of American proletariat rage – indeed, those much decried “low wages” are primarily so dadgum low because Uncle Sam takes such a huge bite out of your paycheck – most journalists never bother going after the IRS or the laborious (if not downright indecipherable) U.S. tax code. A shameful “can’t see the forest for the trees” situation, the mainstream media pretty much ignores the most intrusive arm of the federal government (and with it, the bulky, suspiciously secretive agency that impacts the aggregate American more than any other bureaucratic skein) to focus on the comparably small peanuts of elected officials and other business leaders gaming the system.

And that’s where The New York Times made a big – and quite possibly election-swinging – miscalculation.

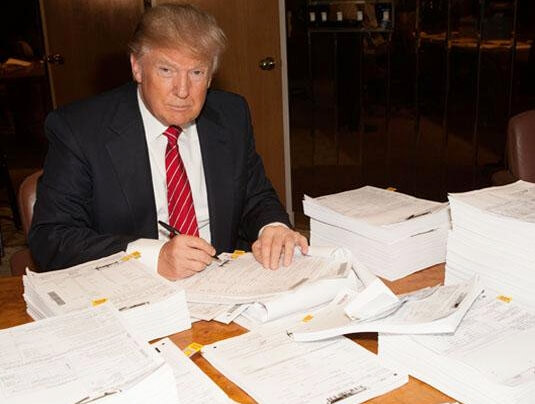

Through some sort of intrepid data collection (which almost certainly wasn’t legally obtained), the Times (whose majority stakeholder, it is rarely noted, just so happens to be Mexico’s wealthiest telecom baron), recently published some hitherto unmentioned tidbits about Donald Trump’s tax returns. Per their reporting, since Trump posted a $900 million loss in the mid-90s, which means he MAY have effectively found a “loophole” to prevent paying any federal taxes for nearly two decades. The intent is unmistakable. The New York Times – which has pretty much abandoned “objective journalism” in favor of a “Get Hillary Elected At All Costs” muckraking jihad over the last six months – thought they had THE smoking gun, that one little sliver of info that would finally – by god, finally – put Donald Trump down for the count. “Those miscreant WHITE MALE Trump supporters may still hate Muslims and Mexicans and Black Lives Matter,” I imagine the NYT editorial board commending themselves in a backdoor, no phones allowed meeting, “but once they realize their golden idol isn’t paying taxes – the same taxes they endlessly complain and bicker about – this election is ALL Hill.”

Indeed, it is rather hypocritical that a man whose entire campaign has been built around some occasionally clumsy economic nationalist populism didn’t pay the IRS their fair keep for (allegedly) 18 years. But in that, the Times committed a huge error: by positing Trump as a man who “beat the system” for nearly 20 years, they have indeed cast him as the proverbial prole dragon slayer.

Here’s the thing about wages in today’s America. If you make only $8.25 an hour and work 40 hours per week, your annual income is $17,160 – which, is $6,000 higher than the current Federal Poverty Level annual income cutoff. But what do you know, if you are being taxed at 30 percent, guess what? Your income rolls back to near FPL levels. Try as the progressives may to rationalize it, the math is indisputable: the foremost driver for poverty in America isn’t a lack of jobs (or even living wages or affordable housing), it’s that your individual tax burden LITERALLY puts you in the poor house.

THAT’s why so many working class stiffs LOATHE entitlement programs. Each year, the blue collar masses have thousands of dollars pilfered from their purses, with the money – by and large – going towards services they themselves aren’t considered poor enough to receive. That alone would explain why the American prole absolutely and utterly despises liberals; they effectively “rob” them of their hard-earned income for the sake of social mobility building programs, only to be told they can’t receive the very benefits they are forced by threat of imprisonment to finance.

But here’s the catch. Trump supporters (and those on the fence heading into the first Tuesday in November) don’t care if other people don’t pay taxes. Yes, they may moan and complain about illegal immigrants getting free services, but the bigger, overarching concern is the taxation system in the U.S. itself. THAT is the oppressive, ominous leviathan that the American electorate – regardless if his or her race, age or socioeconomic status – most tangibly feels each year. Let’s face it: peace accords with Iran and legislation regarding wetlands buffers don’t impact our personal lives in the slightest, but by golly, each and every one of us feels that cold, clenched fist of federal government come tax season.

Trump circumventing paying taxes for 20 years, then, isn’t a negative in the eyes of many – if not most – Americans. If anything, it’s a testament to how keen his business acumen is; I mean, if the dude can hoodwink the most intrusive branch of the government and play ‘em like a fiddle for two decades, how can you not cheer him on? The fact that Trump’s accounting partners found a legal loophole to avoid paying taxes is even sweeter; if you are an American that absolutely abhors the IRS, you’d have to stand in awe of the absolute financial ownage Trump and pals have flaunted in the face of the fed’s behemoth bureaucracy.

Despite CNN and The Huffington Post and the totally 100 percent not-biased Twitter and Facebook “news” algorithms more or less beating the public over the head that Trump is a psychopathic Klan member who wants resurrect Adolf Hitler’s ghost to help send the Mexicans to Antarctica, I’d venture to guess that the main reason a majority of Trump supporters plan on casting their ballot for the orange-skinned populist isn’t because they are Islamophobes covered head to toe in Pepe the Frog tattoos who want David Duke running the Department of Education. Rather, they take one glance at his taxation plan, compared it to what Clinton and Sanders were proposing and said “yep, I reckon I’m going to go with the guy who says he’s taking less money from me.”

It’s that simple, folks. Forget all of the economic nationalism and the crypto-racism and everything else The Atlantic and The Washington Post and Bill Maher have been saying is the “reason” why so many gullible Americans have fallen under Trump’s spell.

Why are people planning on voting for Trump? Well, I’d imagine a lot of it has to with his plans to scale back the individual federal taxation rate to 6 percent for employees earning less than $75,000 a year, increase the standard deduction from $12,600 to $30,000 and eliminate any and all federal tax liability for Americans earning less than $25,000 annually.

Race, age, national origin, gender, sexual orientation and religion has nothing to do with it. If you are keen on economic self-interest – whether you are a janitor at Arby’s or the CEO of a multinational – having Trump in the Oval Office means you’ll get to keep more of your money. Whether or not he keeps the promises he makes, of course, is up in the air, but as of this moment, Trump – whether you want to acknowledge it or not – is pretty much the white knight the masses have been praying would deliver them from the scourge of the ultimate federalist hydra for decades. And the fact that he’s been using the behemoth’s own confounding rules against them only strengthens his position as the “Great Tax Slayer” who fell from the heavens a’la Ash at the end of Evil Dead 2.

Unbeknownst to the Times’ brass – indeed, I hear it is all echoes in such ivory editorial towers – their election-sinking “revelation” about Trump may have very well had the exact opposite effect as they had hoped. Instead of turning Trump’s supporters against their populist demigod, it only reinforces his cult of personality and solidifies his financial wizard image. And for a lot of people on the proverbial sidelines – including traditionally Democratic voters like rust belt whites, southern African-Americans and, irony of ironies, working class Hispanics in the Southwest – Trump’s hardline stance against the IRS might be enough to get them to jump ship come November. I recall watching a video on Periscope recently, in which an African American videographer explained why he was voting for Trump. “Yeah, he lost a billion dollars, but to do that, first you gotta’ make a billion dollars,” he said. “Hillary keeps talking about ‘Black Lives Matter,’ well, my life matters, and I’m too busy fighting life. I don’t know what’s going to happen if Trump wins, but I know that if it does, there’s probably going to be more money in my pocket.”

Perhaps that’s why the spectre of race has been such an omnipresent issue heading into this year’s general election. Taxation is the one governmental topic that supersedes all identity politics, and based on that issue alone, there’s no way the mass media barons can spin it in such a way as to legitimately explain why Hillary’s tax policies are better for working class Americans than Trump’s. In the eyes of the IRS, the only color that matters is green, and if you are prole who desires to maintain more of your salary, electing Trump is a foregone conclusion. (And as an aside? Considering the overwhelming plurality of all minorities in the U.S. are middle class or better, one has to wonder if the Democrats’ semi-racist appeal to “lower class” interests like welfare benefits and public health care options isn’t putting off the 47 percent of African-American households that are considered well above the national average in terms of income?)

Of course, there is quite a bit of irony to go around the whole Trump taxation quagmire. For one, the very tax loophole Trump is being savaged for (possibly) using was – you guessed it – engineered by the Clinton Administration back in 1993. Furthermore, one has to wonder why the Times wasn’t equally aggressive in dissecting the tax returns of the Clinton Foundation – especially considering the fact the organization recently refiled three years worth of income statements that didn’t, in their words, contain “certain supplementary financial information.” And the sweet, succulent, delicious cherry atop the New York Times editorial sundae snafu? The fact that, while they tore Trump apart for potentially not paying taxes, the company itself has been using a tax shelter loophole to avoid paying the government its fair share since 2014.

If there’s anything I’ve learned in a good seven years’ worth of public-centric journalism, it’s that people don’t tend to listen to virtue-signalers whose hypocrisy is palpable from several states over. And when those same hypocrites keep telling you to run and hide from something they don’t like, that’s generally a good enough reason to run towards it with open arms.

So here’s to you, New York Times – the corporate tax avoidin,’ wannabe agenda-settin’, piss-yellow journalizin’ oligarchic media empire that – somehow, someway – managed to turn a presidential campaign-crippling hatchet job into the VERY reason why their object of scorn rose to the most powerful position in global politics. No doubts about it, we’ll surely be reading about your grave error in judgement for years to come – maybe even eight of them, pending how well Trump’s 2020 reelection bid goes.